Immigration is not a strange concept for people from Hong Kong at all.

As small as a city we are, Hong Kong has gone through a handful of immigration phases throughout history. At the end of World War II, indigenous inhabitants in the New Territories of Hong Kong started moving to the United Kingdom and Europe. In the 1970s, Hong Kong residents were already immigrating to Southeast Asia, South Africa, and even South American countries. And, of course, after the establishment of the “Sino-British Joint Declaration” and starting in the 1990s, there was a flood of people immigrating to Canada, Australia, and Singapore. Now, locations like Taiwan, Malaysia, and even Japan are all being considered as immigration options for Hong Kong people.

However, conditions always apply to immigrants, and one of the deal-breakers can well be how long the applicant needs to stay in the country in order to achieve citizenship or residency. This is why Ireland stands out.

1. Stay for a day and qualify for a year!

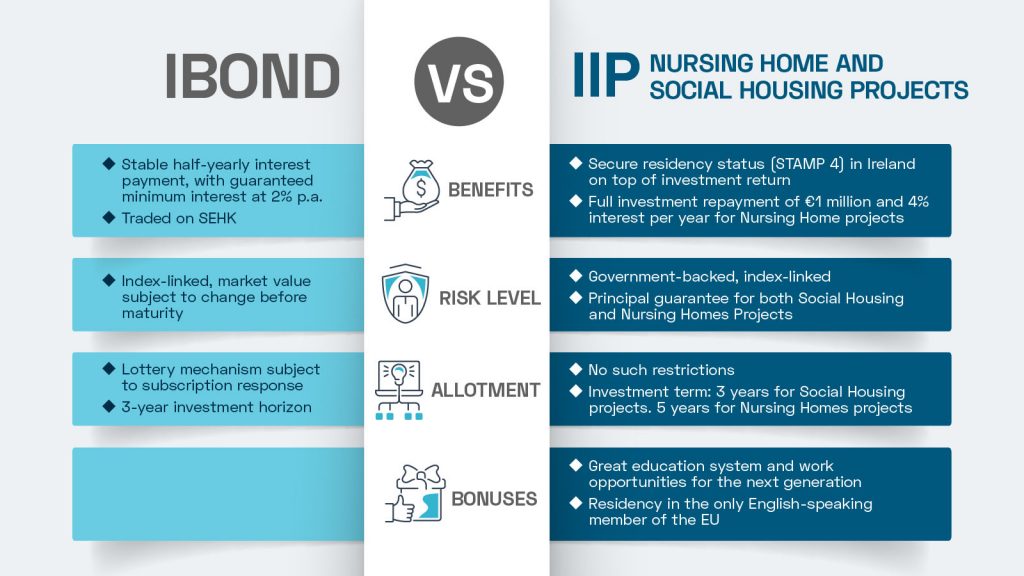

Currently, the two popular options within the IIP investment schemes for people to immigrate to Ireland, 1) a personal donation of €500,000, 2) a corporate investment of €1 million. Though the first route is discounted to €400,000 per person if a group of 5 is donating together, the money is gone after the donation. Therefore, according to the statistical report of the Irish Naturalisation and Immigration Service (INIS) for 2015-2019, more than 70% of applicants have chosen to invest €1 million.

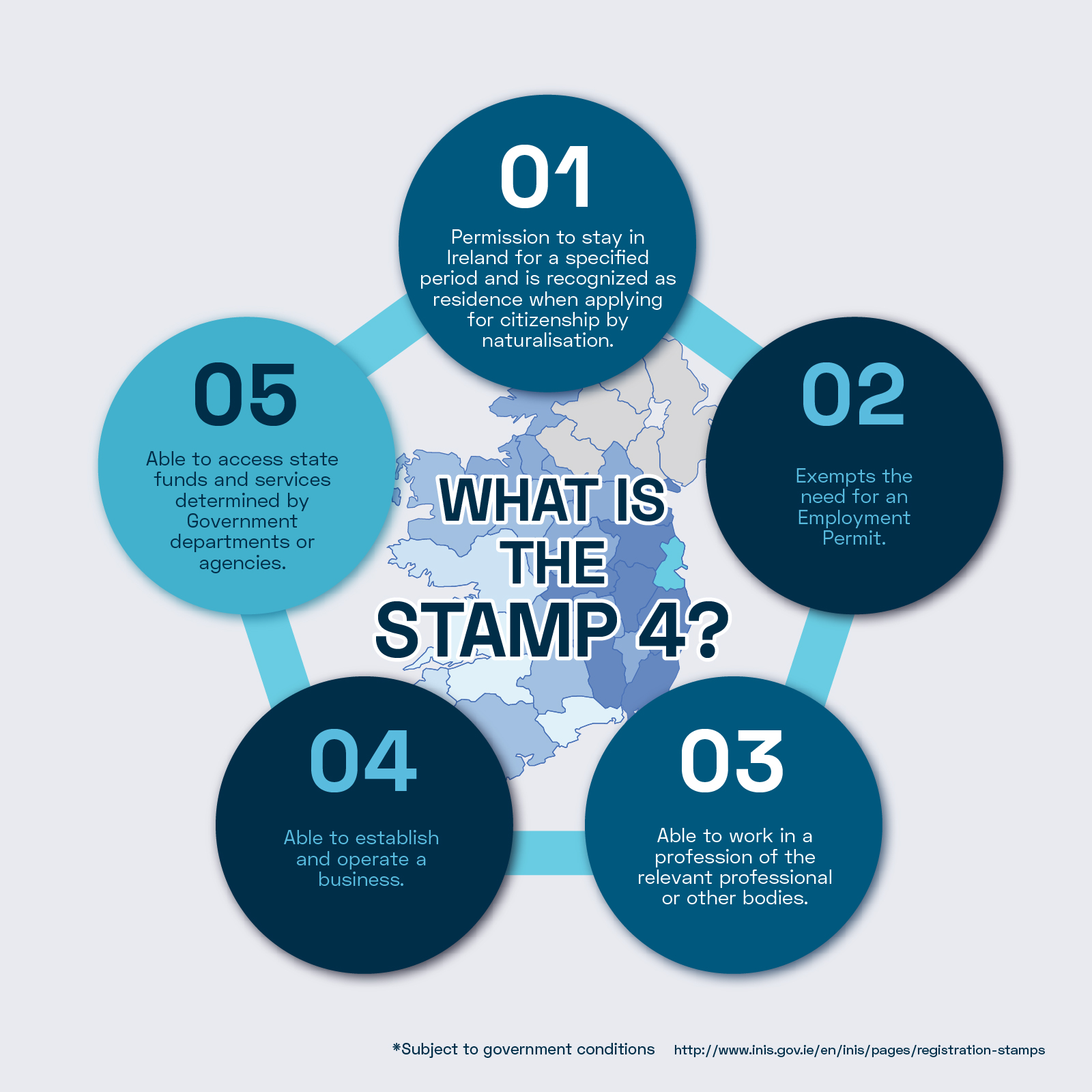

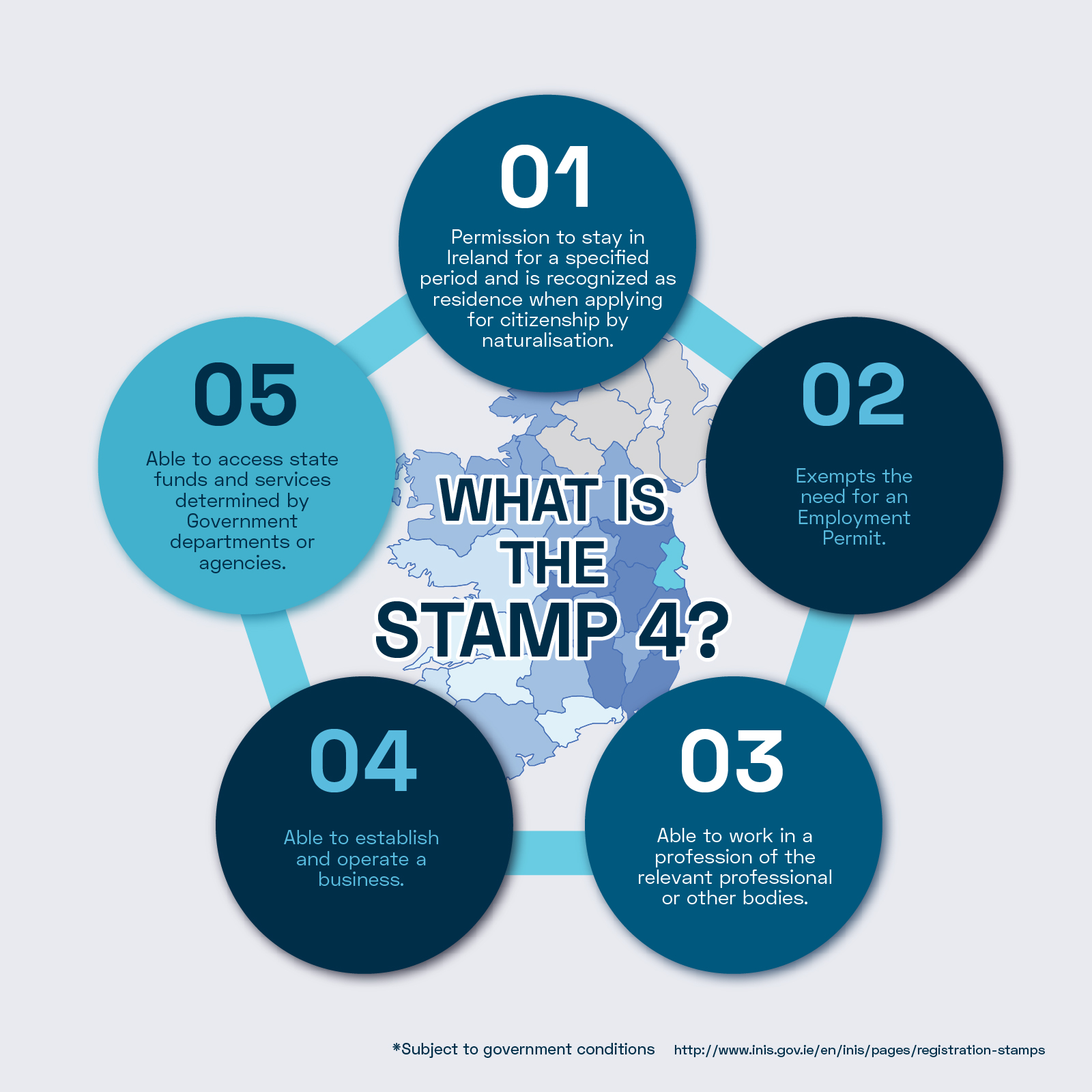

If the applicant decides to go ahead with investment immigration, they will receive the pre-approval letter within 4 to 6 months. Upon receiving the pre-approval letter, the applicant can make their investment within a timeframe of 90 days. If the applicant invests in our Irish Investor Immigration programme (IIP), we will confirm with INIS that the money is received. The earlier the applicant makes their investment, the earlier INIS will issue the applicant their landing permission letter. With that, the applicant can then visit INIS physically to get their Stamp 4 and Irish Residence Permit (IRP) on the first time of their landing.

Subsequently, every year until the applicant wishes to apply for the Ireland passport, they are only required to be in Ireland for 24 hours every year to maintain their permanent resident status. If they arrive at the end of the year and leave at the beginning of the next year, that already fulfills the stay requirement of two years. This highly flexible requirement is perfect for those who are yet or are not considering leaving Hong Kong permanently but want to have an option ready.

2. Earn profit and a new identity.

The donation route can be quite expensive, because the €400,000 or €500,000 poured out will not garner any return, resulting in a “purchased” STAMP 4. The Enterprise Investment, on the other hand, is very different. First of all, approval comes before the investment, and Bartra has a track record of 100% approval rating and a 100% renewal rating within the IIP. This means you are sure to receive your Stamp 4 with your investment. Secondly, within 3-5 years, depending on your choice of investment (nursing homes or social housing with Bartra), your total €1 million investment will be returned. Thirdly, investing in nursing home projects can generate around 4% interest per year. At the maturity of your five-year investment period, you will get an additional of €100,000 to €200,000, on top of your €1 million.

In the end, you get the total capital of €1 million returned, along with a “free” STAMP 4 identity and an extra circa of €200,000.

3. It’s as safe as it gets

We’re not claiming how safe it is ourselves, INIS has identified Nursing Home and Social Housing projects as the preferred investment options for the Immigrant Investor Programme (IIP). Both of the projects are supported by the Irish government, meaning the income is stable and guaranteed. The two projects – nursing homes and social housing, are highly demanded by the Irish market.

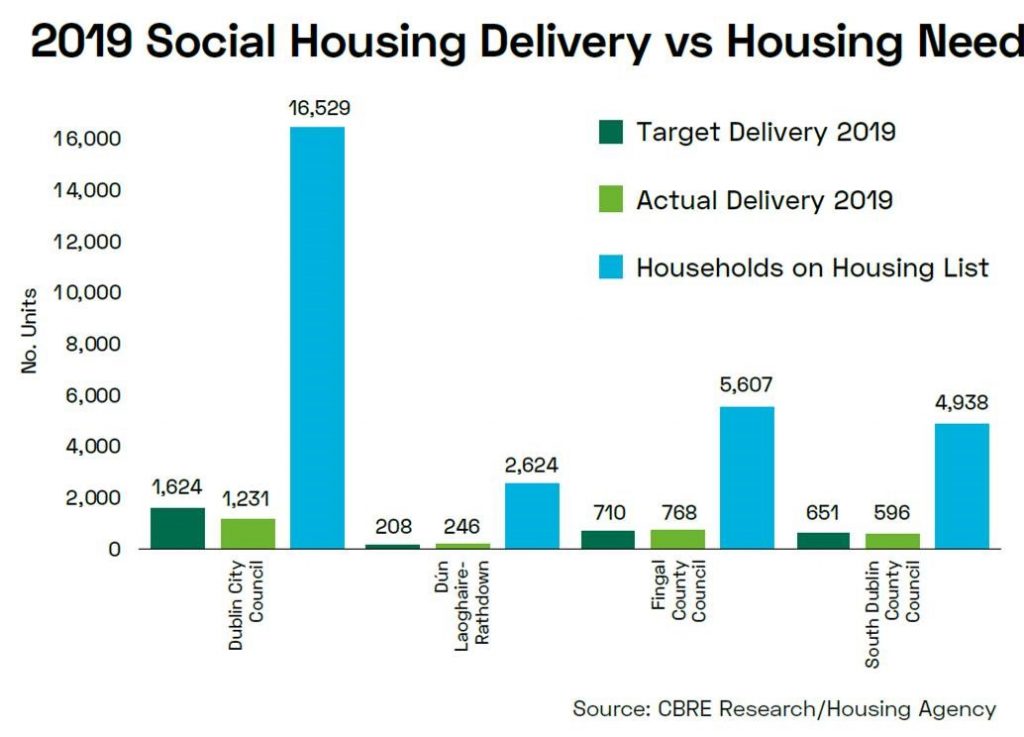

According to the CBRE report, elderlies of 65 and up will take up around 16% of the Irish population by 2026. In such cases, an estimated amount of at least 7,500 additional nursing home beds needs to be delivered. Hence, nursing home projects are subsidized by the National Treatment Purchase Fund (NTPF) and are a part of the strategic plan for reconstructing Ireland. Social housing is also in strong demand, where 68,693 Irish households are waiting to be housed in mid-2019. Yet, there were only 21,241 houses delivered in the same year.

Secondly, projects like ours, which supports the country’s social infrastructure, are given priority by INIS. In particular, our social housing projects have signed a 25-year Enhanced Lease with the local authority at 95% of an agreed market rent, where index-linked and are debt-funded by different companies. The investment risk, therefore, is extremely low, and the safety of the investor’s funds are ensured.

Not to mention, even during the current pandemic, the social housing industry is one of the first to recover and restart, as the Irish government plans to invest about €5.85 billion in this sector by 2021. According to The Sunday Business Post, the private nursing home trading market is anticipated to reach €100 million at the end of 2020.

https://youtu.be/i5uKesfDN40

4. 100% approval rate, 100% renewal rate, 100% transparency

Our projects are quite special as we provide 24-7 live Evercam streaming of our construction for all investors, accessible anywhere with the internet. Our investors are also regularly notified of the project’s progress and can get interesting Ireland and project news via our Facebook and LinkedIn.

On top of that, we are a developer company, not an agency. As a developer who has successfully carried out many social housing and nursing home IIP projects, Bartra is the only one-stop-shop offering immigration service and direct access to investment projects. We have extensive Irish immigration experience and expertise in the investment field, and a strong business network of partners. Our Irish Immigrant Investor Programme (IIP) has helped hundreds of families immigrate to Ireland while maintaining an application approval rate of 100% and a 100% renewal rate.

Our IIP has been around since 2016 and is highly successful, sourcing over €310 million of IIP property-related projects, with a track record of over 250 successful IIP applicants. We have helped them live and freely travel to and from Ireland, the UK, and the 27 countries in the European Union after they have obtained their Irish passport from their STAMP 4 VISA. As the only Irish property developer who has a physical presence in Hong Kong, our unique business model supports clients throughout their investment and immigration journey. Simply scroll down to download your step by step IIP guide and assess if Ireland can be your next move.