To understand the intent and views of the people of Hong Kong on emigrating overseas, Bartra Wealth Advisors (‘Bartra’), a subsidiary of Ireland’s market leading real estate developer and the first Irish immigration investment advisory in Hong Kong, conducted an online survey on emigration. From 1,200 responses, the survey found that 84% of respondents are currently considering or will consider emigrating overseas, among which the majority are high-income individuals including office workers, business people and professionals.

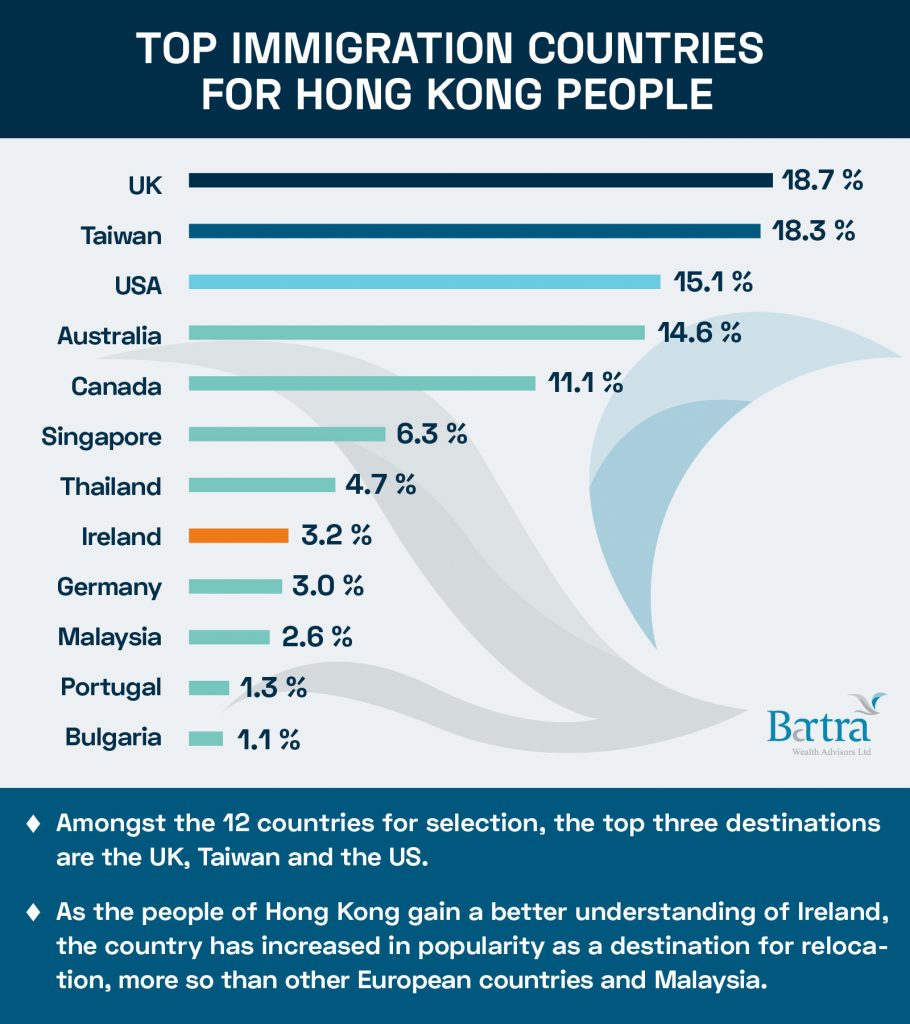

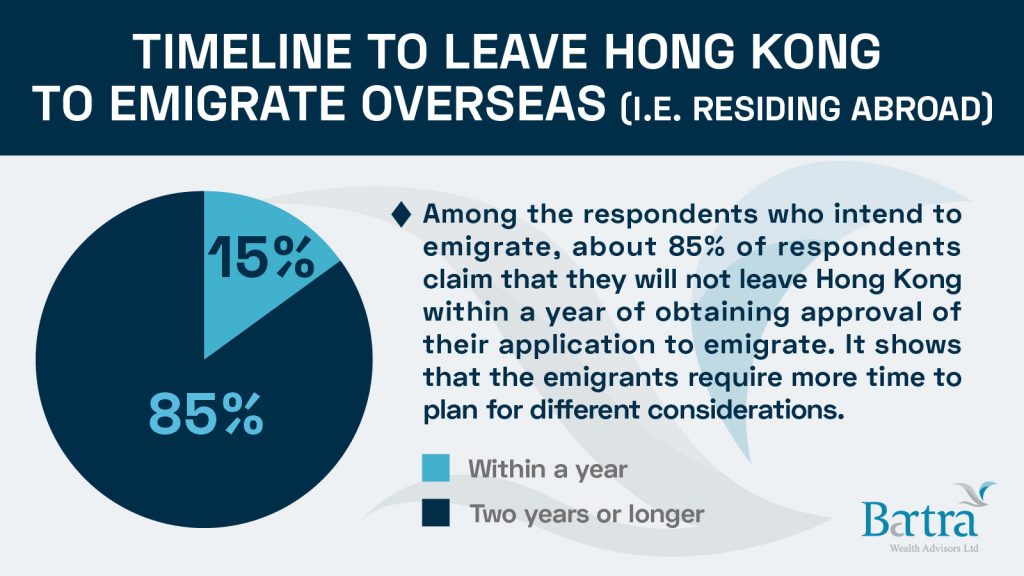

According to the survey, among the respondents who intend to emigrate about 85% of respondents claim that they will not leave Hong Kong within a year of obtaining an approval of their application to emigrate. The survey also found that over 50% of respondents’ decision to emigrate is in order to improve their living environment, while approximately 30% want their children to obtain a better education. To obtain a foreign residency/citizenship and political factors each account for 20%. As the people of Hong Kong gain a better understanding of Ireland, the country has increased in popularity as a destination for relocation, more so than other European countries and Malaysia. Currently, the top three destinations are the UK, Taiwan and the US. Meanwhile, the top three areas of concern for Hongkongers deciding to emigrate are the associated costs, the ease of application and language. Over 40% of respondents have considered obtaining residency by immigration investment, for which they care most about the security, return, and duration of the investment project, according to the findings of the survey.

Jeffrey Ling, Bartra Wealth Advisors Regional Manager, said, “Although the UK is still the top pick for relocation for the people of Hong Kong, uncertainty increased after Brexit which may affect the politico-economic environment in the UK. As a member of the European Union and part of the Common Travel Area with the UK, Ireland, an English-speaking country, is a gateway to both the UK and EU countries with promising business prospects; it is the first choice for many companies looking to relocate their headquarters. Moreover, this survey reveals that Hong Kong people require a great deal of flexibility around application and residency requirements via investment immigration, and they show a high degree of concern about the robustness and security of the investment projects. Both of these requirements are met by the Immigrant Investor Programme (‘IIP’) qualified projects that Bartra offers.”

Since the desire of high-net-worth clients to immigrate is strong and their top choice remains the UK, Bartra recommends they ensure a full understanding of the local investment market performance before immigrating. Wealth and investment management firm Harris Fraser was specially invited to conduct market analysis and share views on investment opportunities and wealth management trends. Cyrus Chan, Harris Fraser Investment Strategist, said, “With widespread vaccination programmes underway, the global economy is expected to recover faster than expected. However, although the UK and the EU came to an agreement for Brexit last year, relevant implementation details still need to be clarified. The troubled British economy may rebound, and the Irish economy will benefit from it. In addition, with the structural changes in the global economic environment, the wealth management needs of high-net-worth clients increase accordingly. Currently, more popular investment strategies include yield enhancement strategy, financial leverage, Euro asset allocation and focus on the healthcare sector.”

The pandemic has disrupted the relocation plans of many people in Hong Kong. According to the survey, Hongkongers require more time as well as a high degree of flexibility when planning for emigration. Jay Cheung, Bartra Wealth Advisors Marketing Director, said, “In the current climate, investment immigration services and products need to have three advantages: 1) high flexibility and fast-track process; 2) product safety and strong demand; 3) ability to add value and integrate with wealth management services.”

By investing in Ireland’s Immigrant Investor Programme (‘IIP’), application will be approved within 4-6 months, and applicants are only required to reside one day per year in Ireland to maintain their residency; in other words, they can obtain a foreign residency without relocating. Many of Bartra’s clients have already been granted permanent residency of Ireland, but have remained living and working in Hong Kong. In addition, Bartra commands unrivalled creditability in Irish immigration consultancy services. The Social Housing and Nursing Home projects Bartra offers to Hong Kong clients planning to obtain permanent residency in Ireland can be achieved in three or five years, and both guarantee 100% investment capital protection. They each have an approval and renewal rate of 100%. In addition, the Nursing Home project has an annual return of 4% paid on maturity, which is fitting of a high demand healthcare sector. As for the ability to integrate wealth management services, apart from cash, IIP applicants can use stocks, funds, cash value of insurance policies, properties, or even parking spaces and valuable paintings and collectibles etc., for asset requirement approval. Some clients will seek advice from financial services to pledge/refinance their assets to fund investment immigration in the current low interest environment so as to obtain residency without exiting from existing investments.